October 6, 2022

Short term or vacation rentals have grown like wildfire in the past 5 years, and this growth affects nearly all destinations in the southeast. Gray Research Solutions has been studying the growth of vacation rentals in tourism since their start in 2013, but lately has been getting more requests to help destinations understand the landscape and implications of vacation rentals than ever before. The issue, of course, is that while hotels and bed and breakfasts have been regulated and taxed for years, rental units listed on rental-by-owner platforms have not. Some destinations have created ordinances and legislation to regulate short term rental units, some have entered voluntary collection agreements (VCAs) with Airbnb and/or vrbo, and some have not done anything. GRS has had success convincing the powers that be of the need to consider regulations by “following the money”: tracing the tax going uncollected and showing how that revenue would impact the budgets of lodging tax beneficiary organizations in the destination.

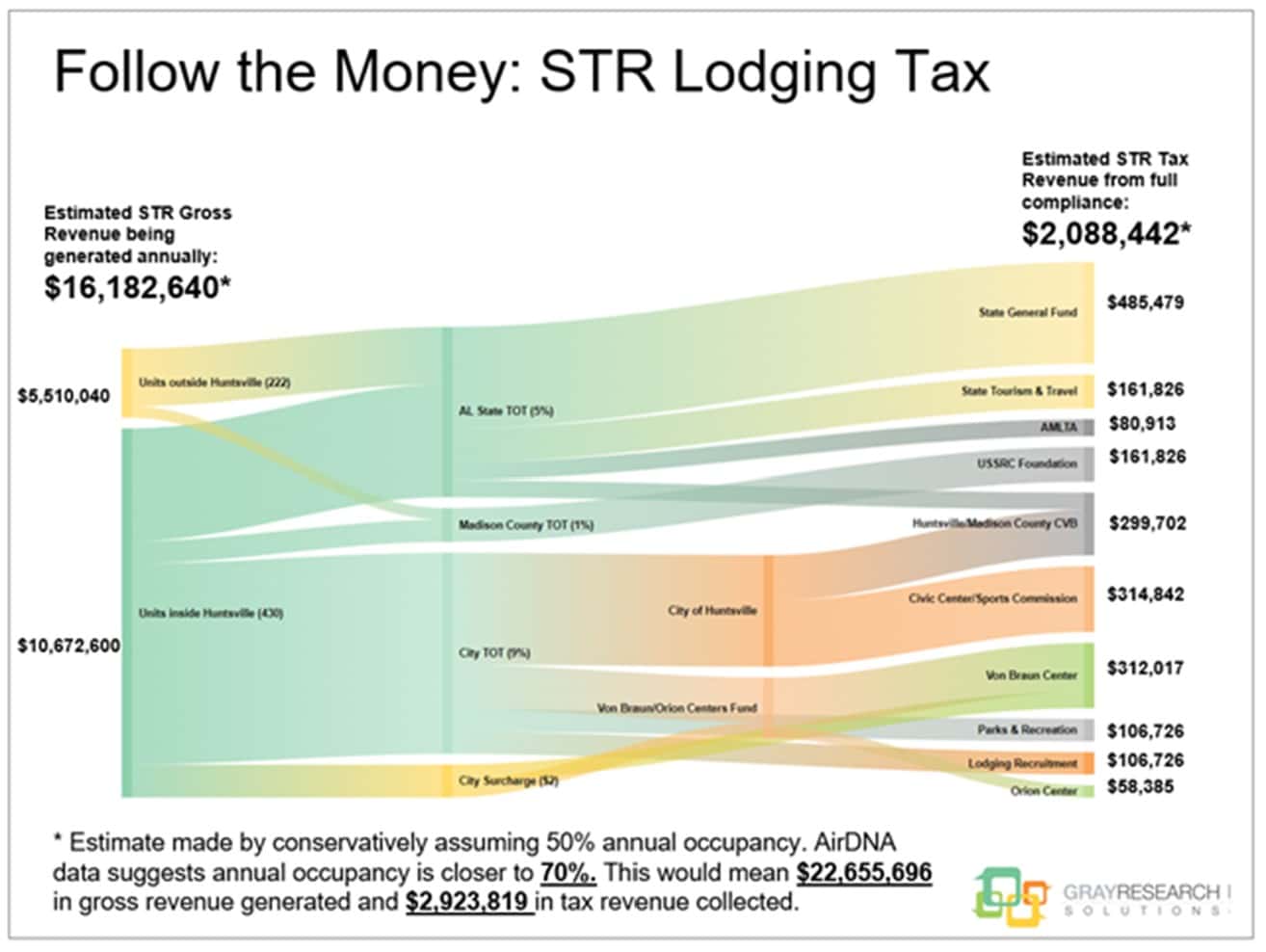

In the counties of the North Alabama Mountain and Lakes region, GRS has been conducting their “DMO Insight Audit” methodology to mine existing destination data and determine what questions, if answered through research, could help move their destination marketing forward. Part of this initiative has been tracing the money flow of lodging taxes, estimating the amount of tax being left on the table by vacation rental revenue, and showing how that tax revenue would impact the budgets of the organizations that benefit from it based on the city, county and/or state legislation currently in place.

During a presentation of the VR Money Flow map for Madison County, the Director of the Alabama Tourism Department Lee Sentell realized that while state short term rental taxes were being remitted by Airbnb and vrbo, local short term rental taxes were by and large NOT being collected (with beach destinations as the exception). To remedy this, he decided to fund a $400,000 grant on a compliance program to locate and communicate with vacation rental hosts.

Research matters!