September 23, 2025

When Will Canadian Travel to the U.S. Rebound?

U.S. state tourism offices and city DMO’s and other travel-related businesses are trying to make sense of the downturn in Canadian travel demand for the U.S. travel product. One important question being asked is when will Canadian travel to the U.S. start to rebound? The XBorder Canada program is designed to provide state tourism offices and city DMO’s year over year and month over month travel sentiment shifts. XBorder Canada surveys over 3,500 Canadians each month to pinpoint when Canadian traveler demand to visit the U.S. begins to rebound. The monthly Canada survey tracks sentiment to the U.S. and by all states and select cities.

Before the Downturn

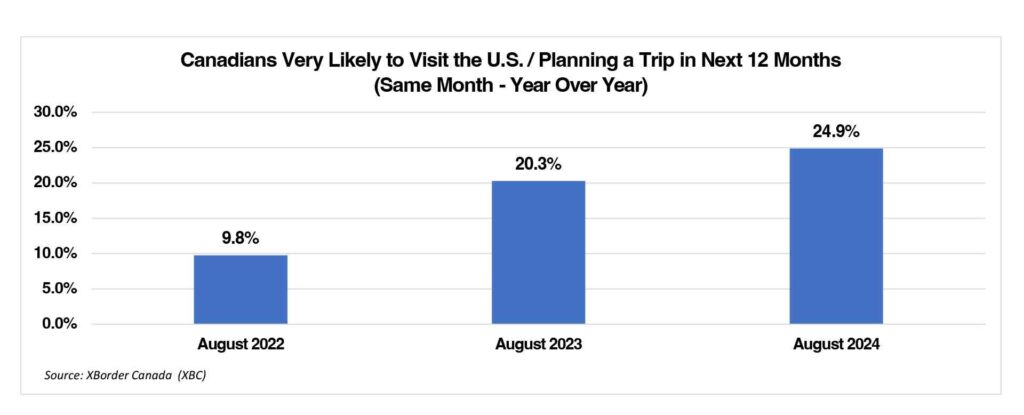

In August 2024 XBorder Canada’s monthly travel intentions survey reported 25% of all Canadian travelers were “very likely to visit / planning a trip” to the U.S. in the next 12 months. By comparison, the 2023 August travel intentions survey reported only 20% of Canadians were very likely to visit the U.S. in the next 12 months, nearly doubling the August 2002 sentiment. The year over year comparison from the XBC intentions survey pointed to positive demand growth for 2024. Travel intentions continued on a positive note through October 2024 (26% of all Canadian travelers were very likely to visit the U.S.). Demand for travel to the U.S. was growing.

The Bottom?

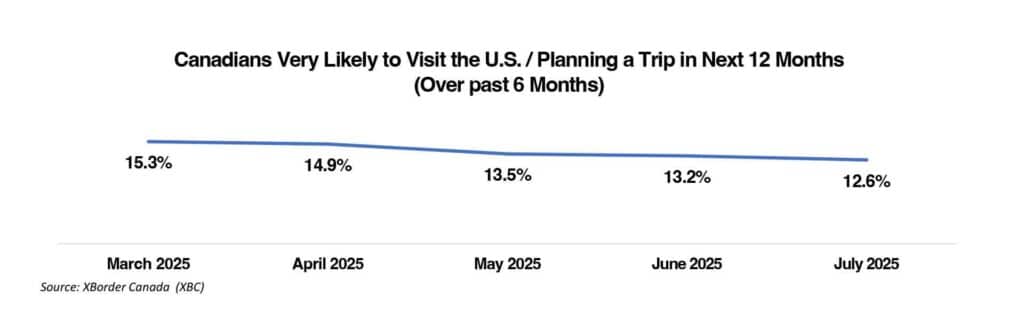

However, by March 2025 the Canada travel intentions survey reported that only 15% of Canadians were very likely to visit / planning a trip to U.S. destinations in the next 12 months.

Unfortunately for the U.S., elbows were up! Each monthly XBorder Canada intentions survey reported a decline month over month through July 2025. The July 2025 survey reported only 12.6% of Canadians indicated they were very likely planning a trip to visit the U.S in the next 12 months.

The Impact

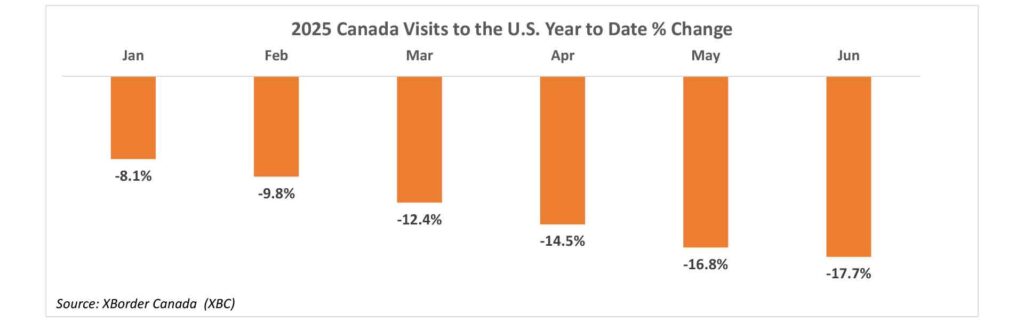

Canadian visits to the U.S. through June 2025 (the latest official data) are down -17.7%, with air down -11.2% and land lagging more at -24.8% compared to 2024 for the same time period. The downturn in Canadian travel to the U.S. has been well reported, much of it tied to the U.S. insertion of tariffs on Canadian products, political rhetoric (“51st state”), along with the cost of travel to the U.S. (inflation within the U.S. and a strong dollar) and concerns about border crossing, crime, and overall safety. Official Canadian visit data through June 2025 registered 8.16 million overnight visits to U.S. destinations (this excludes day visits to U.S. states and cities). By comparison, June YTD 2024 visits to the U.S. were 9.9 million overnight visits, registering a year over year loss of 1.74 million visits for the first six months of 2025.

From any point of view, a loss of 1.74 million visits has a dramatic impact. But, to put Canada’s importance into perspective for state and city tourism offices, it makes sense to compare Canada to the top 20 overseas countries, which registered 2.49 million U.S. overnight visits in the same time period (January – June 2025). Even with the double-digit loss in visits, Canada visits to U.S. destinations through June 2025 were 3.2 times larger than the top 20 overseas countries combined (and that excludes Canadian day visits). This highlights, despite the downturn, Canada will likely remain a top overnight market for most states.

The Rebound?

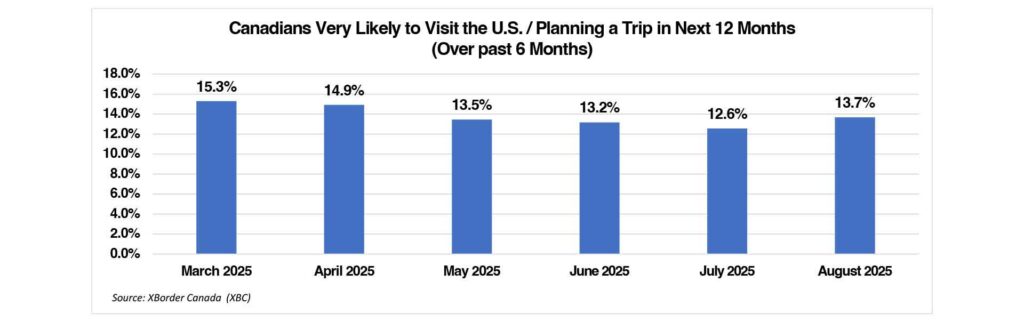

The August 2025 XBorder Canada travel intentions survey reported the first positive uptick since October 2024. In August 2025 the XBorder Canada monthly travel intentions survey reported that 13.7% of Canadian travelers were very likely to visit the U.S. / planning a trip in the next 12 months, up from the low of 12.6% reported in July 2025.

Takeaway for DMOs:

Visuals should reflect authenticity and evoke a strong sense of place. Digital storytelling should highlight not only the aesthetics, but also the cultural richness and local narratives that make your destination distinct.

Scott Johnson, co-founder of XBorder Canada, said “the small uptick of Canadians planning a trip to the U.S. in the next 12 months is a welcome breath of fresh air for the U.S. travel industry. It is the first indication that the bottom may have been found and that demand could be on the rise or at the very least, stable.”

The XBorder Canada August 2025 travel intentions survey reported that the majority of Canadians that are planning to visit the U.S. in the next 12 months are planning that visit this year – in 2025. This is good news and points to a potential stronger finish for 2025 than recently forecast. However, the August 2025 XBC travel intentions report also indicated that longer-term travel planning beyond the next six months may be limited due to the level of uncertainty in the current environment.

Additionally, the August 2025 XBC travel intentions survey reported 19.0% of respondents said that they had cancelled or delayed all U.S. 2025 travel plans (down slightly from 20.0% in July). Also, 13.4% said that they have cut back on their U.S. travel plans – reduced the number of trips or the length of trips, which was similar to recent months. The August survey reported the top reasons which had a major impact on their decision not to visit or to reduce travel to the U.S. in 2025 included:

- General Political Situation (60.8%)

- Boycotting due to U.S. Tariffs (56.6%)

- Boycotting due to Threats of 51st State (46.1%)

- Cost/Price/Exchange Rate (44.7%)

- Hassle at the Border (37.6%)

- Crime/Safety (23.4%)

Who’s Coming?

Through June 2025 8.16 million Canadian overnight trips were taken to the U.S. (excludes day visits). The August 2025 XBC monthly Canada travel intentions survey reported, of those Canadians who are somewhat / very likely to visit the U.S / planning a trip in the next 12 months, the largest age cohort is the 25-39 age group (37.5%), corresponding most directly with millennials (29-44 years old). The second largest age group is the 40-54 year olds (24.6%). “This indicates that millennials may be taking the steering wheel and could reshape demand for travel products going forward,” said Johnson.

The August 2025 survey also reported the top destinations they plan to visit. Of those Canadians that are somewhat / very likely to visit the U.S. overnight in the next 12 months, the top states that they are planning to visit include:

- New York

- California

- Florida

- Nevada

- Texas

- Illinois

- Massachusetts

- Washington

- Arizona

- Hawaii

The XBorder Canada program is an official source for the U.S. Department of Commerce-National Travel and Tourism Office, other federal entities, and various states and cities. Each month XBorder Canada surveys over 3,500 Canadian travelers making it the largest ongoing monthly survey of Canadian travel that reports state and city-level Canadian visitor spending for both day and overnight visitors by all modes (land, sea, air). Surveys are collected via online panels. A similar probably sample would result in a margin of error of +/- 1.6%. In addition, the XBC monthly travel intentions survey tracks visitor intentions by state (and select cities) helping to understand future demand by destination.

To learn how the XBorder Canada program can help your state / city / region understand your Canadian visitor data story, please reach out to our team at in**@***********da.com or call (518) 668-2559.